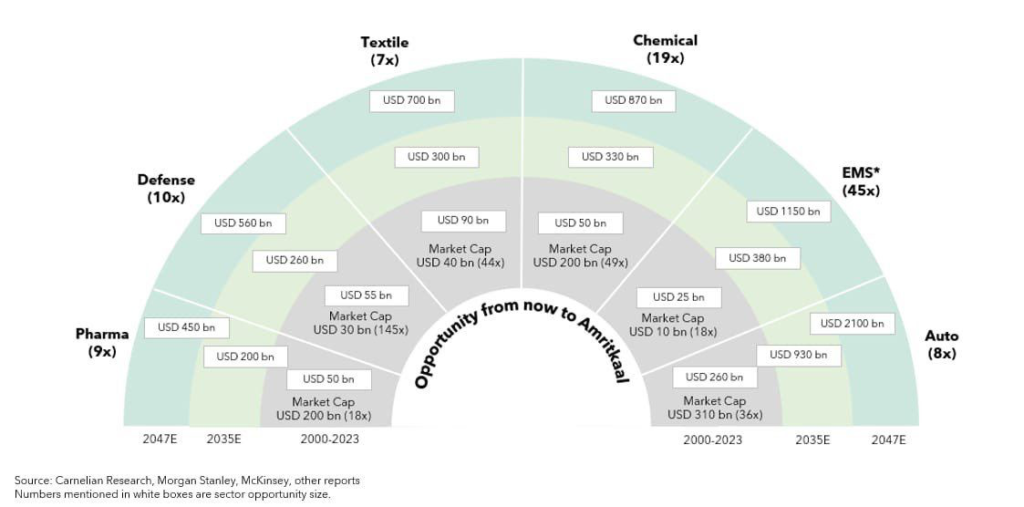

The image you provided depicts the potential opportunity size for various sectors in India from now until 2047. The sectors are represented by different colored segments of a pie chart, with the size of each segment indicating the estimated opportunity size in billions of US dollars.

Here’s a summary of the key takeaways:

Overall Opportunity:

- The total opportunity size across all sectors is estimated to be USD 2100 billion.

- The sectors with the largest potential opportunities are EMS (USD 1150 billion), Auto (USD 930 billion), and Chemical (USD 870 billion).

- The sectors with the smallest potential opportunities are Textile (USD 700 billion) and Pharma (USD 450 billion).

Sector-Specific Opportunities:

- EMS (Engineering, Manufacturing, and Services): This sector is projected to have the largest opportunity, with a potential size of USD 1150 billion. ex Amber, Dixon Tech and Kaynes, pgel

- Auto (Automotive): The auto sector is expected to have a significant opportunity of USD 930 billion. ex Tata motors and Mahindra although Auto is down side for now

- Chemical: The chemical sector is also poised for growth, with an estimated opportunity of USD 870 billion. ex Aarthi Industries, Deepak Fertilizerd

- Textile: While smaller than the top three sectors, the textile sector still presents a substantial opportunity of USD 700 billion.

- Pharma: The pharmaceutical sector is projected to have an opportunity of USD 450 billion. ex Laurus Labs , Dr Reddys, Divis Lab

- Defense: The defense sector is estimated to have an opportunity of USD 560 billion.

Market Capitalization:

- The image also shows the market capitalization of each sector.

- In general, the market capitalization is lower than the estimated opportunity size, indicating potential for further growth and investment in these sectors.

Overall, the image suggests that India has a significant potential for economic growth across various sectors, particularly in EMS, auto, and chemicals.

Note: The data in the image is based on estimates and projections from various sources, including Carnelian Research, Morgan Stanley, McKinsey, and other reports. The actual opportunity size may vary depending on various factors.