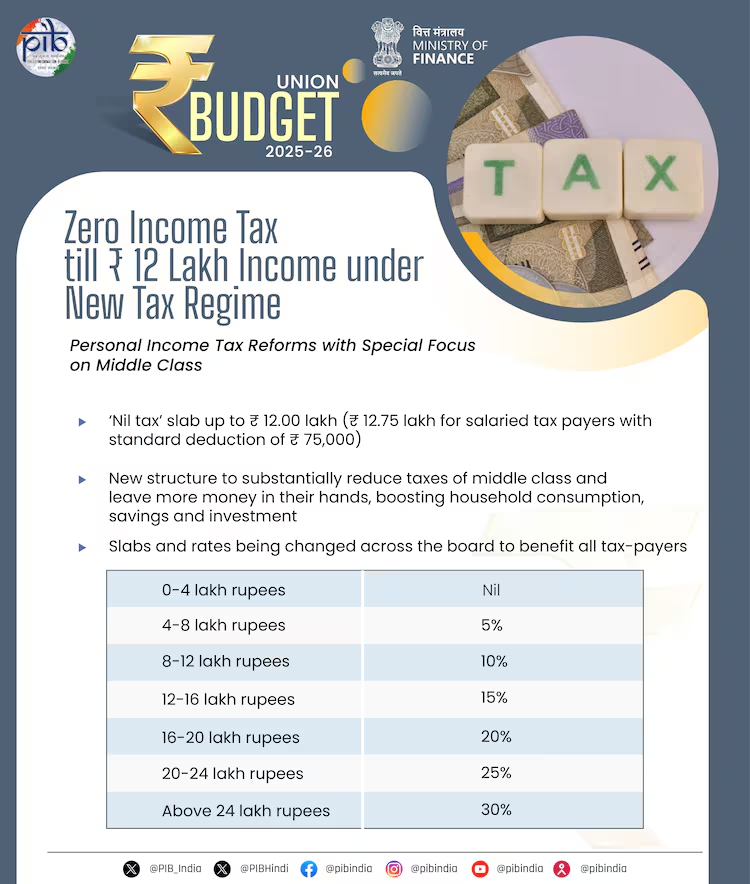

The Finance Minister has introduced the long-awaited income tax slab, bringing much-needed relief and excitement to salaried individuals. After several years of unmet expectations, the new tax regime has finally delivered, offering significant benefits. Notably, there is now no income tax for those earning up to 12 lakhs annually.

Example: Salaried Individuals Earning Up to 24 Lakhs

New Tax FY24-25: Previously, the government collected up to 4.1 lakhs in taxes from individuals earning up to 24 lakhs annually.

New Tax FY25-26: Under the new tax regime, the tax collected from the same income bracket will be reduced to 3 lakhs.

Net Savings would be close to 1 lac approx subject to correction for tax payers who opted for new tax regime and not applicable to who are in old tax regime and taking exemptions through PF,HRA and other investment.

Rationale:

Any tax exempted should be collected else where through Tax hike in other slab, GST or Pterol price hike. Govt was able to do it easily as 76% have unexpectedly given up old tax regime where HRA and other exemptions can be claimed and were willing to pay high tax amounting to unbelievable 1 lac crore plus extra tax revenue. Therefore govt just nullified UNJUSTIFIED high tax in next tax regime ensuring there is balance between old tax regime and new tax regime. Govt is mulling to abolish to old tax regime where people are taking close to 1.5 lac crore as refund every year and huge over head to verify such claims and transactions by govt. Conclusion, Govt charged way excessively last year which has been rectified this year.

This change signifies a substantial reduction in tax liability, providing more financial freedom and support to salaried individuals. The new tax slab is a significant step towards a more equitable and supportive tax system for the working population.

Author

Sumanth- Powered by GenAI